Advertisement advertisements

PIS/PASEP application, great as it is simple and easy to use the platform. When it comes to simplifying essential services through technology, practicality and time optimization take center stage.

It reminded me two days ago that consulting information related to company finances and deposits required a visit to the banking agency.

The result was a considerable loss of time, consumed by seemingly endless lines on the benches.

Currently, for example, Checking the PIS balance can be done through the cell phone., without drying out of the house. Public officials can also access or Pass through the Caixa Trabalhador application.

What is this PIS/Pasep?

Before sharing our experience with the Caixa Trabalhador application, it is crucial to understand how the PIS and Pasep operate.

Advertisement advertisements

The Social Integration Program (PIS) and the Public Service Heritage Training Program (PASEP) are government undertakings that open, respectively, private sector workers and public officials.

Through these programs, government entities and corporations deposit contributions in a fund associated with employees, called Fundo de Amparo ao Trabalhador (FAT).

The Caixa Econômica Federal is the entity responsible for the payment of the PIS, while the Banco do Brasil supervises the distribution of the amounts of the Pasep.

These resources are only intended to cover the Salary Payment and Employment Insurance, both with the function of offering support to workers.

I emphasize that all workers governed by the Consolidação das Leis do Balho (CLT) have direct access to these benefits.

Who Is Enabled?

To receive the PIS/Pasep amounts, some criteria must be satisfied. Firstly, you received two minimum salaries with formal registration.

Além disso, ter worked for, at least, 30 consecutive or intermittent days.

It is also a requirement to be registered in the PIS/Pasep for, at least, five years and to have the updated data in the Annual Report of Social Information (Rais).

It is important to note that, if these conditions are not met, the salary payment will not be granted. The criteria are assemelham.

As with other payments made by Caixa, the withdrawal of the PIS/Pasep follows an annual calendar, usually structured according to the anniversaries of the beneficiaries.

Therefore, it is essential to be attentive to all information so as not to lose data. I am not faced with a situation of not being able to recover the necessary amounts due to carelessness in terms of costs.

PIS X Fertilizer Rates – What Sets You Apart?

There is still confusion between some terms that appear to have the same meaning: PIS quotas, PIS credit and yield. The PIS limits, in reality, consist of special contributions.

They are created for the employers, following a format of quota proportional to the time of service and the salary of the collaborator.

However, not all workers are directly at these levels, only those who were active between 1971 and 1988.

On the other hand, the salary payment is an annual percentage paid back. Currently, the value is equivalent to 1/12 of the minimum wage.

This value is multiplied by the number of months worked. Being registered in PIS is one of two pre-requisites to qualify for a subscription.

Read this to follow:

|

PIS/PASEP 2023 Calendar |

|

Empréstimo Bolsa Família: How to Apply and Take Advantage of This Opportunity |

|

Free Online Courses to become a Marceneiro |

PIS performance

The performance of PIS was also a quest that generated doubts in me. Meanwhile, understanding this dynamic is simple.

Workers directly at the PIS levels may receive corrected amounts according to the balance. These amounts are corrected according to the PIS yields.

The removal of these amounts follows the same logic as the PIS dimensions. The value can only be redeemed by formal workers, ou seja, those who have earned money and who contributed before October 1988.

Collaborators who contribute after this data are not directly related.

The Caixa Trabalhador Application Facility

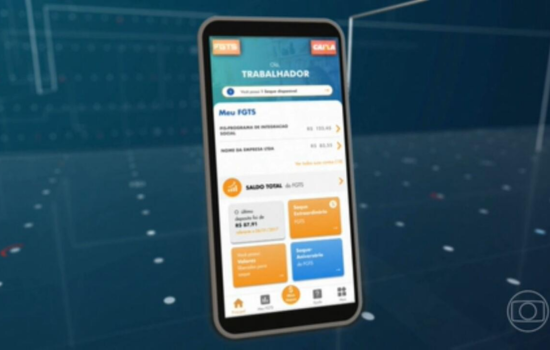

Now, share your experience with the Caixa Trabalhador application. The app was officially launched in 2016 by Caixa as a practical and free digital tool for workers.

Its focus is on the availability of information instead of carrying out transfers and transfers, tasks that are only addressed by another Caixa application.

My first impression was not favorable, due to the criticism directed at the platform.

Also, Caixa's strategy of launching multiple applications, whose functionalities can be integrated into a single solution, also receives questions.

However, when I installed the app on my cell phone, I was surprised with the practicality provided.

For someone who usually leaves a bank and wastes time in lines just to check the PIS balance, investing a few minutes on the platform is a mere detail.

The program was conceived with solutions that simplify access to the amounts of PIS/Pasep and FGTS due to the worker.

Platform Operations

Thousands of workers have the right to carry out the withdrawal of PIS/Pasep, with payments following a previously disclosed schedule.

To access information and know the values available for release, simply navigate through the application menu and select “View Values” after creating a value.

By means of the tool, I can consult my PIS/Pasep balance, the released parcels, or payment schedule, or employment insurance and salary payment.

In addition, you can solve your doubts through the clarification center integrated into the application.

Benefits of the Caixa Trabalhador Application

One of the main advantages of using the Caixa Trabalhador application is, without doubt, a practicality.

Imagine being able to check your balance without having to leave home? As a non-cellular application, access to consultation tools and the benefits calculator is convenient.

Another benefit is in comfort. With a few touches, I obtain information about the values that are due to me, without the inconvenience of long lines.

In addition, Caixa has other applications that we also provide.

In this way, it is easier to be up to date on the updates and recommendations of other applications in the same segment.

Access to precise information also makes everything different, including non-official content. By means of the application, it is possible to accompany the correct PIS/Pasep payment schedules (SEE MORE BELOW).

Or Step by Step to Download or Application

The application is available for download both in the Google Play Store and in the Apple App Store.

Simply access one of the application stores and enter “Caixa Trabalhador” in the search bar, then execute or download.

To open the application, you need to enter the NIS and CPF number, then click “Access”.

If you have a balance of PIS, it will be necessary to create a cadastre with your child. The payment values will be ready for consultation in accordance with the disclosed calendar.

Carrying out the PIS/Pasep pelo App

The withdrawal of the PIS/Pasep can be carried out directly in the electronic boxes of the respective banks responsible, or seja, to Caixa or Banco do Brasil.

However, for those who do not have access to any of these institutions, the alternative is to use the Caixa Tem application, as well as fiz.

As well as the Caixa Trabalhador itself, the Caixa Tem provides information on emergency assistance, PIS/Pasep, unemployment insurance, FGTS and other work rights.

In addition to balance consultation, users can carry out transactions.

The application's functionalities include transfers, purchases with virtual debit cards, both in physical establishments and online, payment of tickets and request of withdrawals.

In the last case of use, opt for a transfer. No tax collection has been made and the value was credited to the bank account holder in just one business day.

Or Guide to Baixar or Caixa Tem Application

Assim as the Caixa Trabalhador, or Caixa Tem is compatible with devices Android and iOS, eo download is free.

If you have a cadastre on the site of the federal government, it can be used to access tools.

To obtain a cadastre, it is possible to carry out the procedure quickly using the CPF number and a six-digit numerical code.

Feito isso, the platform will be ready for use. Particularly, Caixa Tem stands out as one of the bank's most relevant applications, offering various functionalities that can be beneficial for employees without employment in institutions, such as the EU.

Also, users who have access to this platform can use the value available through the PIX.

However, I must emphasize that my attempt to transfer using this service is not successful. Ainda assim, it's not hard to tempt, isn't it?

User Impressions

Chegou now it's true! The Caixa applications have aspects that can be improved.

For example, the interface is still quite basic and lacks two attractions present on platforms such as Nubank and C6.

Also, on some days, the applications present technical errors. On certain occasions, I may not be able to log in.

On the other hand, there are applications that are intuitive to use. na Google Play Store, the Caixa Trabalhador receives an evaluation of 3.5 stars.

Likewise, user Antônio da Silva Souza mentioned that the application does not load and displays previously reported errors, without the developers having provided corrections.

Check out the box and receive a 4-star rating and receive more positive comments.

In summary, the experience with the Caixa applications is similar, with aspects to be appreciated, but also with advantages you will notice.

Also, technology is constantly evolving, and it is hoped that these platforms will be improved to better serve Brazilian workers.